BEACON Third-Party Agent FAQS - Unemployment Insurance

NOTE: A third-party agent is an individual authorized by an employer to act on its behalf. A third-party agent is required to have an active Power of Attorney approved by the Maryland Division of Unemployment Insurance (Division) to perform tasks on behalf of an employer. For details, see question #3 .

The BEACON unemployment insurance (UI) system provides a central portal for third-party agents to perform several UI tasks, including. For more about BEACON, see the BEACON System Overview webpage.

- When you log in to BEACON, you will be in your personal BEACON portal.

1. How can third-party agents register or activate accounts in BEACON?

A third-party agent can register or activate an account on the BEACON agent log in webpage.

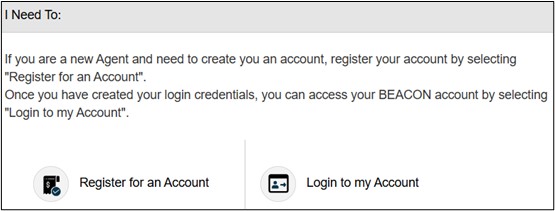

- A third-party agent who does not have a Maryland third-party agent UI account number (also referred to as an agent ID number) should select Register for an Account and follow the prompts to register for an account number and to create a BEACON account.

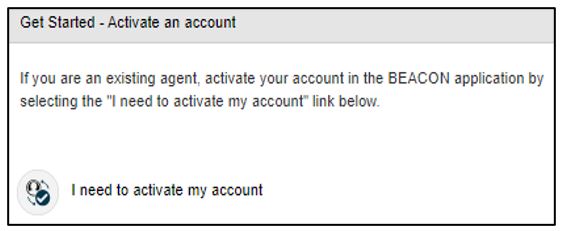

NOTE: An employer must use a third-party agent UI account number when authorizing the agent to perform work on their behalf. - An agent who has a Maryland third-party agent UI account number should select I need to activate my account and follow the prompts.

For details, see the BEACON Account Activation and Registration for Employers and Third-Party Agents webpage.

2. How do third-party agents access their Maryland UI account numbers?

A third-party agent will receive a Maryland third-party agent UI account number (also referred to as an ID number) immediately after completing the registration process in BEACON.

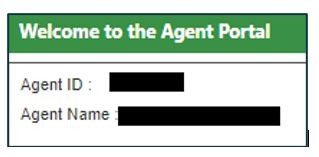

To access the account number, a third-party agent should log in to BEACON. The agent’s account number (also called an ID number) will be in the upper left corner of the screen.

3. How can a third-party agent maintain a Power of Attorney?

To maintain a Power of Attorney (POA) in BEACON:

- Navigate to your portal's left menu and select Account Maintenance;

- Select the Maintain POA icon.

- Enter the client’s employer ID (to be provided by the client) and select Search.

- Use the Select POA button to upload the POA file and select Save. Once the POA is uploaded, the Division will review the documentation prior to approval.

Through the Power of Attorney (POA), an employer can authorize a third-party agent to perform specific duties on their behalf (submitting payments, accessing benefit charges, etc.), including duties which may be performed in BEACON.

NOTE: A third-party agent BEACON account can have:

- one individual user; or,

- multiple users who access the same account using individual login credentials.

4. How can a third-party agent view payment information?

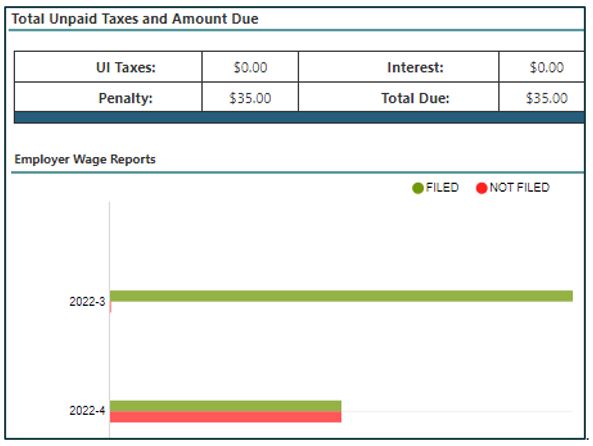

When a third-party agent logs in to BEACON, the portal homepage will display the total unpaid taxes and penalty charges, as well as recent quarterly wage reports (also called quarterly contribution and employment reports) that were filed or are due.

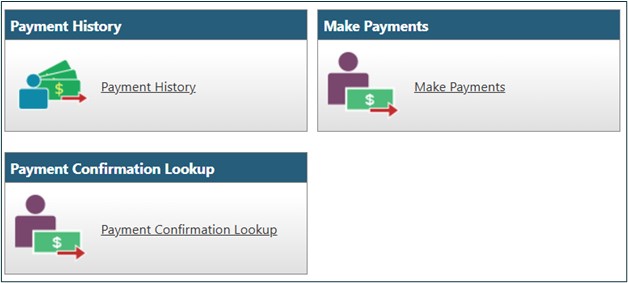

A third-party agent can also access payment confirmations, payment history information, and make payments in BEACON. To access these options, navigate to the left menu and select Payments. The screen below will display, and the third-party agent can select the relevant option to proceed.

5. How can third-party agents make payments on behalf of clients?

Third-party agents making a payment on behalf of an employer may pay by ACH debit or ACH credit in BEACON or by paper check. Payment instructions are available in the Maryland BEACON Agent Payment Allocation Files document and in the Third Party Payment Submission tutorial video.

To make payments in BEACON:

- Log in to BEACON. Navigate to your portal's left menu and select Payments.

- Select Make Payments. The employer name and the amount owed will be displayed. Choose whether you will manually allocate payments or submit a payment allocation file and follow the prompts.

To make an ACH credit or ACH debit payment:

- The third-party agent must generate the allocation file in the BEACON agent portal and then proceed to make payments.

- A third-party agent who chooses to make payments by ACH debit will need to enter their bank account number and routing number.

- If a third-party agent chooses to make payments by ACH credit, the agent must download the ACH credit file from BEACON and send the file to their bank.

Check Payment - If you are a third-party agent who submits a payment by check, note that posting a check payment to the proper employer’s account requires manual intervention, which will cause a delay in processing the payment.

6. How do third-party agents file quarterly contribution and employment reports?

To file a report in BEACON:

- Select Wage Submission from your portal's left menu. Then, review the clients who have not submitted wage reports and select Next.

- Enter an email address and select the file type from the dropdown menu.

To learn more about submitting contribution (wage) reports, see the BEACON Third-Party Agent Wage Upload video and the Third Party Agents Wage File Specifications document.

7. What resources can third-party agents use to learn more about BEACON?

To learn more about BEACON, third-party agents can see:

- BEACON Tutorial Videos for Employers and Third-Party Agents

- BEACON Account Activation and Registration for Employers and Third-Party Agents

- Employer and Third-Party Agent Instructions for Submitting Files in BEACON

For additional questions, contact the Employer Call Center at 410-949-0033.